Benefits For Our Veterans.

There is a little-known Veteran’s Benefit that could put thousands in your pocket.

The Department of Veteran Affairs offers a special benefit to war-era Veterans and their surviving spouses. It is a pension benefit well-hidden from common knowledge and thousands of Veterans are missing out on benefits they could be receiving right now.

As an active-duty Veteran, you, at one time, wrote a blank check payable to the United States of America for an amount of “up to and including your life.” That’s why we love telling all our Veterans about this almost-secret program.

Thank You For Your Service!

Your service to our country is appreciated and we will do all we can to help you enjoy the benefits you (and your family) deserve for such a commitment.

This little-known program is a tax-free benefit designed to provide financial assistance to help cover the cost of long-term care:

• in your home

• in an assisted living facility or

• in a nursing home

This benefit is for those Veterans and surviving spouses who require the regular attendance of another person or caregiver in at least two Activities of Daily Living (ADLs) such as:

• bathing

• dressing

• eating

• toileting

• transferring

How to Know if You Qualify

Are you a war-time Veteran or the surviving spouse of a war-time Veteran?

Are you over 65?

Do you now, or might you in the future, require assistance in at least two Activities of Daily Living (ADLs), such as bathing, dressing, eating, toileting, or transferring?

Are you receiving a VA Disability check larger than the Long Term Care Benefit value listed below?

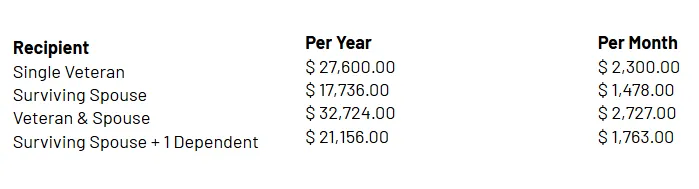

Veteran’s Long-Term Care Benefit Value

Understanding these requirements before you need the income is paramount. We can help you get your well-deserved TAX-FREE BENEFIT. The above numbers are as of November 27, 2024.

VA BENEFITS, PENSIONS & MILITARY RETIREMENT

It’s called the Aid & Attendance Benefit and it’s one of the biggest secrets out there. That’s why we’re trying our best to spread the word and help the brave men and women who have served this country – and their families – position their estates to be eligible if and when they would qualify.

VA pensions and military retirement pay are NOT the same thing. This particular program is for qualifying Veterans who have a qualifying financial need and were not dishonorably discharged.

To qualify you must meet one or more of these requirements:

• Age 65 or older

• Permanently disabled (not due to your own misconduct)

• Receiving skilled nursing care

• Receiving Social Security disability benefits

Your “yearly family income must be less than the amount set by Congress to qualify.”

BUT WAIT!

You are not required to be impoverished to qualify. You don’t have to have service-related disabilities to qualify.

Yes. Your “net worth” is a huge part of the equation, but advance planning can help you qualify financially prior to needing any services. As in all estate planning, time is of the essence. AFEPI has helped hundreds of Veterans and their spouses legally position themselves to take advantage of this great program.

HOW DO YOU QUALIFY FOR THESE VETERANS BENEFITS?

This program requires a Veteran (or spouse) must have a net worth limit of $155,356 (as of December 1, 2023), which will increase each year with cost-of-living adjustments.

There is also a 3-year “look back” to determine if the Veteran transferred assets in order to qualify for benefits. Applicants will have to disclose all financial transactions for 3 years prior to the application.

Applicants who transferred assets to put themselves below the net worth limit within 3 years of applying for benefits will be subject to a penalty period that can last as long as five years.

AFEPI’s VA-certified attorney and staff will help you determine if you qualify, and if not, what steps are necessary for you to become qualified to receive your pension at the time you need it.

Take the First Step Today!

Don’t leave your future to chance. The decisions you make today shape the legacy you leave tomorrow. Our team of dedicated estate planning professionals is here to guide you through the process with clarity, care, and expertise. Whether you’re looking to protect your loved ones, preserve your assets, or minimize tax burdens, we’re committed to providing solutions tailored to your unique goals.

Here’s what you can expect from your complimentary consultation:

A Comprehensive Review of Your Needs: We’ll take the time to understand your financial and family situation, your goals, and your concerns.

Clear Explanations: Estate planning can feel overwhelming, but we simplify the jargon and outline your options in straightforward terms.

Tailored Strategies: Whether it’s asset protection, tax advantage accounts, or veterans’ trusts, we provide recommendations that align with your specific circumstances.

A Path Forward: You’ll leave with a clear understanding of your next steps and how we can support you in achieving your estate planning goals.

Why Wait? Your Future

Deserves Attention Now.

Don’t leave your future to chance. The decisions you make today shape the legacy you leave tomorrow. Our team of dedicated estate planning professionals is here to guide you through the process with clarity, care, and expertise. Whether you’re looking to protect your loved ones, preserve your assets, or minimize tax burdens, we’re committed to providing solutions tailored to your unique goals.

I Consent to Receive SMS Notifications, Alerts & Occasional Marketing Communication from AFEPI Northwest. Message frequency varies. Message & data rates may apply. You can reply STOP to unsubscribe at any time.

Let’s Build Your Legacy Together

The best time to secure your future is now. Whether you’re just starting or need to refine your current plan, We're here to help you navigate the complexities of estate planning and asset protection with care and expertise.